DeFi Lending Overview

The market value of Decentralized Finance is estimated at 16.33 billion USD in 2023, with the growth rate forecasted at 46% from 2023 to 2030. As an evolutionary development in the DeFi ecosystem, DeFi lending is one of the largest DeFi markets with a TVL(Total Value Locked) of $14.95 billion, accounting for 40% of total TVL in DeFi as of June 2023. The top lending protocols(LPs) are AAVE, Compound, and JustLend. In a normal DeFi lending flow, users have to deposit or lock their crypto-asset holdings in the liquidity pool beforehand as collaterals, and the liquidity position grants users the power to borrow crypto-assets with lending terms highly driven by the supply-demand dynamics.

Liquidation Mechanisms

There is an assortment of factors engendering loan default and collateral liquidation. In AAVE, the index called health factor is devised to measure the collateralized positions of borrower accounts. If it drops below 1, liquidators can execute the liquidation calls towards those accounts, which involve paying back the debt and receiving discounted collaterals. From the health factor calculation, it can be inferred that the volatility of collateral price plays an important role. The spike or plunge of crypto collaterals can induce massive liquidation in Defi protocols, intensifying the fragility of the market. One note-worthy stress-test event is the ‘Black Thursday’ event on 12 March 2020, when the 20% drop in Ether caused 16 million liquidations in LPs.

Within the Compound Protocol, the possibility of liquidation looms over negative liquidity accounts. The liquidity assessment of these accounts involves multiplying the supplied balance by the collateral factor prevailing in the market, and subsequently summing the results while deducting any borrowed balances. Notably, both asset borrowing and asset withdrawal actions diminish Liquidity and augment the account’s vulnerability.

Liquidation and Default Risk

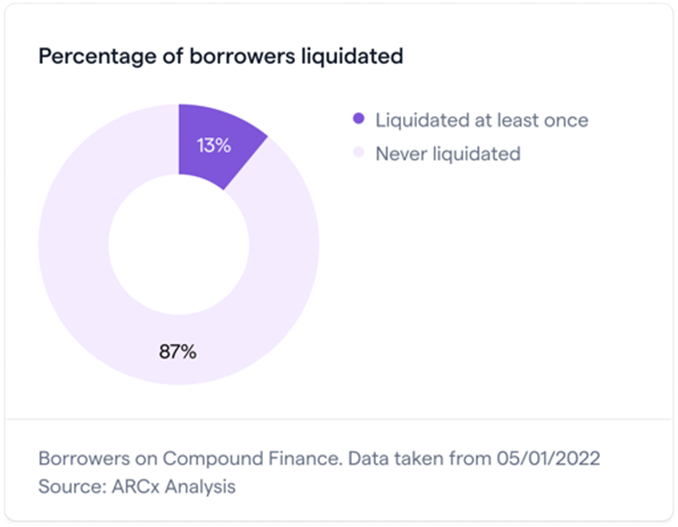

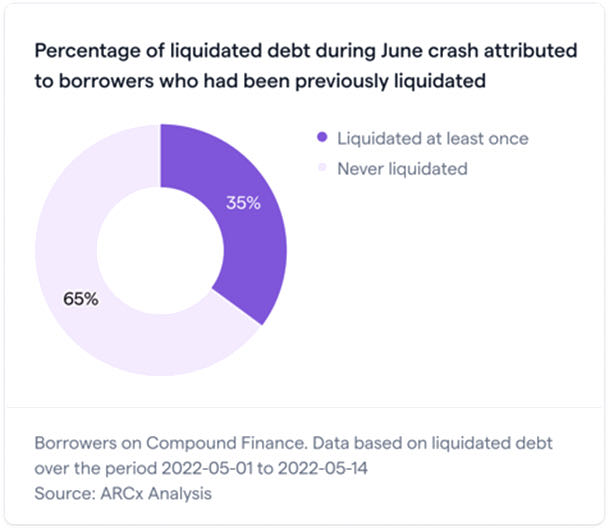

Beyond the market environment and account position, past user behavior can also be taken into consideration when making loan and liquidation decisions. It is researched that accounts that have a default history hold only a small percentage of the participants’ population, yet they are responsible for a large portion of the liquidated debts. Figure 1 shows that for May 2022, 13% of borrowers that had been liquidated could take 35% of the liquidations in the June crash in that year. Hence, it can be inferred that the myriad risks are accounts-oriented, and account-based risk is more of the focus.